2019 Ultimate Plan Sponsor Survey {DOWNLOAD}

Welcome to the 3rd edition of the Retirement Plan Roadshow Plan Sponsor Survey! It’s intended to serve as an invaluable resource for beginner-to-advanced plan sponsors, 401(k) ‘geeks,’ and anyone else looking to identify trends and market changes.

This is a collection of data from 1432 retirement plan sponsor respondents who volunteered to participate in our nationwide survey. It includes:

• Summary of Respondents

• Fiduciary Training

• Topics of Interest

• Searches and Hires

• Time Since Last RFP

• Evaluating or Adding Investments

• Plan Sponsors Questions from 2018

Below is a summary and some of our thoughts.

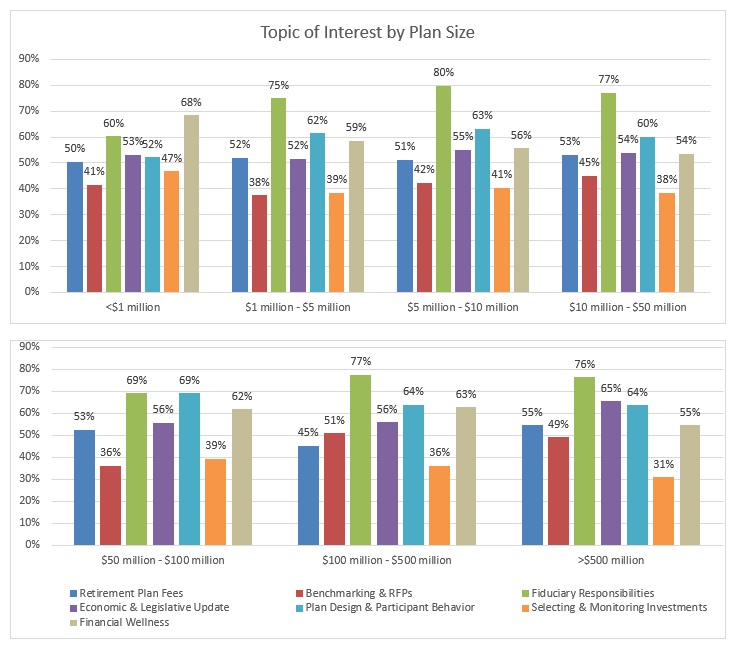

Key Topics of Interest

Fiduciary Responsibility is the number one topics of interest for the year! This was also the case for our previous survey report. However fiduciary responsibilities did trend downward as a topic of interest by about 5% for 401k plan sponsors and 14% for 403b plans sponsors compared to last year. Smaller plans across all plan types also appear to be slightly less interested in the topic too. We attribute this to the fiduciary rule no longer being in headlines everywhere for 2018. It would be safe to assume that if you see the fiduciary rule in the headlines next year, fiduciary responsibilities will pull plan sponsors attention again back towards the topic.

Selecting and monitoring investments was again the least topic of interest among all plan types and sizes. It will be interesting to see as CIT’s continue to grow how this topic may become of more interest to plan sponsors.

The subject of Financial Wellness continues to increase in popularity especially among mid and smaller-sized plans.

Need For Fiduciary Training

Plan sponsors with larger plans or that have a defined benefit plan tend to have fiduciary training. Too many plan sponsors across the board continue to need better training regarding their responsibilities.

Hiring for Services

Recordkeeper and Advisors searches appear to have dropped significantly from last year. We offer two possible explanations for this:

The fiduciary rule drove a huge uptick last year to drive plan sponsors to consider Recordkeeper and Advisors searches, but many of those searches were put on hold or became less of a priority as the rule lost steam.

The stock market from 2017 to 2018 provided low volatility during most of the time frame for which our survey information was collected. We believe that plan sponsors react to their retirement plans based on performance of investments, stock market, and volatility. High highs or low lows push plan sponsors to consider investment changes, conduct benchmarking, issue RFPs, etc.

Additionally, a significant number of plan sponsors are searching for Health and Welfare Benefits services across the board.

Plan Sponsors Question Highlights from 2018

Here are some of our favorite questions submitted by plan sponsors last year:

What is the best resource to benchmark how much we pay our third-party retirement recordkeeping, administration, and consulting firm? When benchmarking fees, do we include this fee along with the expense ratios of the funds or do we benchmark them separately?

What is the difference between the Safe Harbor plans and the plans that require testing? When is it a good/bad idea to have a safe harbor. Is it # of employees, compensation driven, better decision for the company, etc.?

How frequently should you review your plan?

Why doesn’t the DOL mandate a time frame for retirement plans to go out to bid? Do they have a recommended RFP/RFI template? This could help a lot of employers and increase competition and drive down costs.

Recently went over 100 employees and 50M in assets, would like an update on any fiduciary changes. What should I do as my plan and company grow?